The latest NDIS Quarterly Report (to 30 June 2025) highlights important trends in both the financial sustainability of the scheme and participant outcomes. Below we break down the key findings, with a closer look at Specialist Disability Accommodation (SDA).

Financial Performance & Sustainability

Annual cost growth has slowed to 10.8%, below the projected 12% in the 2024 Annual Financial Sustainability Report (AFSR). Total scheme expenses for the first nine months of 2024–25 reached $34.2 billion — $740 million lower than forecast. Inflation and over-budget plans have also eased to 5.0%, down from 7.6% the year before. This is largely due to the effects of the October 2023 change in legislation, which only allows participants to access extra funding due to a change in circumstances or if they have been misused by providers at no fault of the participant. Many participants on the insurance scheme are feeling the crunch of plans without their recommended support levels, with previously approved supports being slashed in recent plans. The impact on participants has been showing, with some comitting suicide after beig unable to access their supports.

26,500 new participants joined the NDIS in the June quarter, reflecting continued demand. The foundational supports promised in October 2023 are yet to be agreed on, contributing to the “only lifeboat effect” which the NDIS represents for people with disability in Australia.

Positive Participant Outcomes & Experience

Community and social participation has improved significantly for participants who have been in the scheme for more than two years. For example, in the 15–24 age group, paid work participation has risen from 10% to 23%, while broader measures of choice and control show 80% of participants aged 15+ feel empowered by the scheme.

Specialist Disability Accommodation (SDA): Growth, Demand, and What It Means

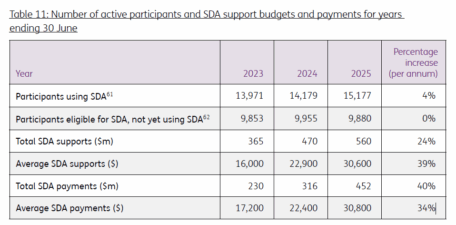

The number of enrolled SDA dwellings continues to increase, with 11,642 dwellings across Australia at June 2025. This represents a 21% annual increase over the past two years and a 23% increase (2,155 dwellings) compared to June 2024. Payments for SDA have also nearly doubled, from $230 million to $452 million in two years, an average annual increase of 40%.

While participants using SDA have grown modestly (around 4% annually), many with approved funding are still waiting to move due to reasons such as vacancies, new builds underway, wanting to stay in the homes they’ve been living for several years or suitability and location challenges.

Growth has been particularly strong in Robust dwellings (up 43%) and High Physical Support dwellings (up 39%), reflecting demand for complex support housing.

SDA benchmark prices were updated on 1 July 2023, and from 1 July 2024 SDA funding amounts in plans are now automatically indexed annually. Previously, this was a manual process taking months. This provides certainty for both participants and providers while also helping the NDIS to allocate staffing levels to more pertinent problems.

You can find this table in the NDIS Quarterly report here.

National Snapshot

All states and territories (except ACT and Queensland) recorded increases in SDA supply this quarter. This shows strong national progress, though local markets remain patchy.

The NDIS is moving toward greater financial stability while continuing to deliver improved outcomes for participants. For SDA, growth in supply and payments shows strong system investment, but the gap between those approved and those using SDA remains a challenge. Ensuring suitable supply and smooth transitions will be critical to meet future demand.